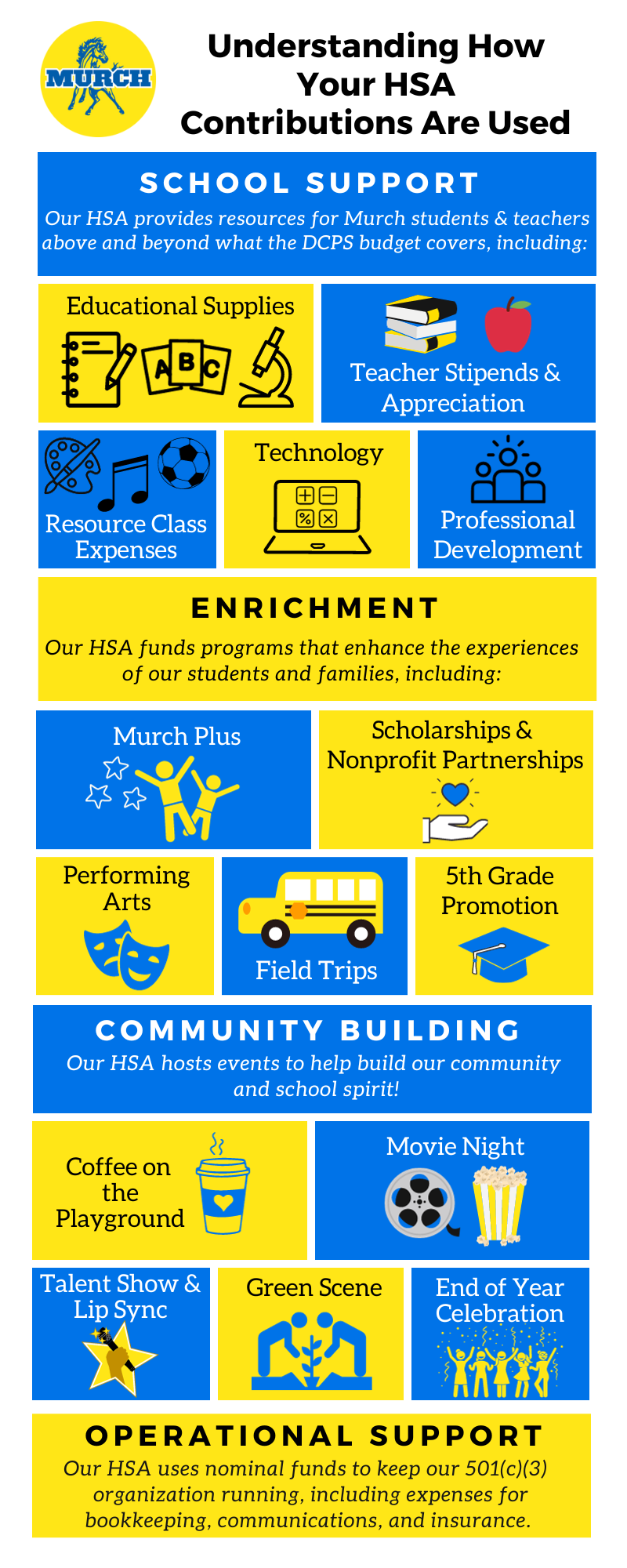

The Support Our School (SOS) Campaign is the Murch Home and School Association's (HSA's) annual fundraiser that makes so much of what we love at Murch possible—field trips, after-school programs, the arts, student scholarships, community events, teacher appreciation, and so much more!

Your donations directly enrich our children's education with resources beyond what the DCPS budget can provide, and every gift is fully tax-deductible.

The SOS Campaign has two important goals this year:

- Encourage 100% participation from all Murch families.

- Raise $110,000 to provide the resources and support needed by all Murch students from Pre-K to 5th grade.

Support at any level makes a difference! We recognize not everyone can give at the same level and encourage you to consider a gift of any size that is appropriate to your family’s budget. While an average of $500 per child would allow us to meet our financial goals, every gift is appreciated and helps keep our community strong.

Donations are 100% tax deductible. The Murch HSA is a 501(c)(3) non-profit organization, and you will receive a receipt documenting your donation via email.

Contribute in Easy Monthly Installments:

You can donate online or by check– it’s easy!

All donations to the Murch HSA are voluntary and tax deductible. To donate online, click the "Donate Now!" button and complete the form. Prefer to send a check? Please mail to: Murch SOS, PO Box 6356, Washington, DC 20015

Questions? Please email sos@murchschool.org or see our Frequently Asked Questions here.

How does the HSA support Murch?

Jason Levin, 2022-23 SOS Co-Chair, sat down with Murch faculty and staff to understand how the HSA supports their work.

Principal Cebrzynski

Ms. Lilley

Ms. Brady

Mr. Hawkins

Ms. Miller

Mr. Hayden

Dr. Branch

Ms. Berger

"Due to the HSA teacher grant program, my classroom has significant changes and upgrades which would not be possible without the support the wonderful parents of our community give our teachers. The teacher grant program alleviates stress and makes our students and teachers happy -- what else could you ask for?" -- Katelyn Brady - K-2 Reading Specialist

"Due to the HSA teacher grant program, my classroom has significant changes and upgrades which would not be possible without the support the wonderful parents of our community give our teachers. The teacher grant program alleviates stress and makes our students and teachers happy -- what else could you ask for?" -- Katelyn Brady - K-2 Reading Specialist

"Without the HSA Teacher Grant Program, I would not have as many amazing resources and tools in my classroom as I do now. Each year, the grant program helps me to introduce new and exciting activities to my students that I would not have the opportunity to do otherwise." -- Alicia Pines - ELL Teacher

"Without the HSA Teacher Grant Program, I would not have as many amazing resources and tools in my classroom as I do now. Each year, the grant program helps me to introduce new and exciting activities to my students that I would not have the opportunity to do otherwise." -- Alicia Pines - ELL Teacher

Does your workplace have a United Way program?

If your workplace has a donation program via the United Way, you may prefer to donate to the Murch Home & School Association (HSA) that way. The Murch HSA is not a member agency of the United Way campaign. However, it is possible for you to write in Murch on your pledge card. Simply list the donation amount and the following information:

Ben W. Murch Home & School Association

PO BOX 6356

Washington, DC 20015

Tax Identification Number (TIN): 52-6053804

If you contribute through your employee donation program, please still submit an SOS pledge form to the HSA, indicating your donation, so that we may acknowledge your contribution.